Tariff Classification and Certification Procedures for Visual and Auditory Materials of an Educational, Scientific, and Cultural Character

Memorandum D10-15-3

Ottawa, July 8, 2014

This document is also available in PDF (157 KB) [help with PDF files]

In Brief

- The list of tariff items has been updated to reflect legislative changes. Other changes have been made for clarification but do not affect any of the existing policies or procedures.

This memorandum outlines and explains the tariff classification and certification procedures for tariff item Nos. 3705.90.10, 8523.49.10, 8523.51.10, 8523.59.10, 8523.80.10.

Legislation

Tariff item 3705.90.10

Slides and slide films when they (a) are of an educational, scientific or cultural character within the meaning of the Agreement for Facilitating the International Circulation of Visual and Auditory Materials of an Educational, Scientific and Cultural Character adopted at Beirut, Lebanon, in 1948, and (b) have been certified by the Government or by a recognized representative authority of the Government of the country of production or by an appropriate representative of the United Nations Educational, Scientific and Cultural Organization as being of an international educational, scientific or cultural character.

Tariff items 8523.49.10, 8523.51.10, 8523.59.10, 8523.80.10

Of an educational, scientific or cultural character, within the meaning of the Agreement for Facilitating the International Circulation of Visual and Auditory Materials of an Educational, Scientific and Cultural Character adopted at Beirut, Lebanon, in 1948, and certified by the Government or by a recognized representative authority of the Government of the country of production or by an appropriate representative of the United Nations Educational, Scientific and Cultural Organization as being of an international educational, scientific or cultural character.

Article I of the agreement for facilitating the international circulation of visual and auditory materials of an educational, scientific and cultural character adopted at Beirut, Lebanon in 1948.

Article I

Visual and auditory materials shall be deemed to be of an educational, scientific and cultural character:

- (a) when their primary purpose or effect is to instruct or inform through the development of a subject or aspect of a subject, or when their content is such as to maintain, increase or diffuse knowledge, and augment international understanding and goodwill; and

- (b) when the materials are representative, authentic, and accurate; and

- (c) when the technical quality is such that it does not interfere with the use made of the material.

Guidelines and General Information

1. In accordance with Article I of the Beirut Agreement, the visual and auditory goods classified under the listed tariff items must be certified, as being of an educational, scientific or cultural character, by the appropriate governmental agency of the state wherein the goods originated. In addition, the Department of Canadian Heritage may confirm whether or not the visual and auditory goods can be considered to be of an educational, scientific and cultural character for the purpose of the listed tariff items. For the visual and auditory goods produced by international organizations, the United Nations Educational, Scientific and Cultural Organization provides the certification.

2. The main purpose or effect of the visual and auditory goods classifiable under the listed tariff items must be to instruct or inform through the development or aspect of a subject, or to maintain, increase or diffuse knowledge, and to augment international understanding and goodwill. The goods must also be representative, authentic and accurate, and of a technical quality making them adequate for use.

3. Prior to importation, the visual and auditory goods that are to be classified under the listed tariff items must be certified in accordance with those tariff items. Certificates are issued by the representative certifying authority in the country of production.

4. The Department of Canadian Heritage has excluded certain visual and auditory goods from the benefits of these tariff items when their primary purpose or effect is the following:

- (a) to amuse or entertain;

- (b) to inform about current events (newsreels, newscasts, spot news);

- (c) to claim exclusivity or to favour one organization or geographical area over another;

- (d) to make public service announcements;

- (e) to subvert international understanding and goodwill or when the goods may be perceived to lend themselves to the misrepresentation of Canada or other countries, their people or institutions;

- (f) to stimulate the use of a patented process or product; to advertise a particular commercial organization and its product(s) or individual(s); to promote tourism; or to raise funds or appeal for support; or

- (g) to influence, by special pleading, opinion, conviction or policy (religious, economic or political propaganda) or to indicate any dogma; or to constitute a ritual or denominational service.

5. In addition, sound recordings are not admissible when imported for sale or rental unless they are for use by educational, scientific or cultural institutions or societies.

6. Also, educational, scientific or cultural institutions or societies must be distinct, permanent and identifiable entities established either for research, the transmission of knowledge or the representation of a country, its people or institutions.

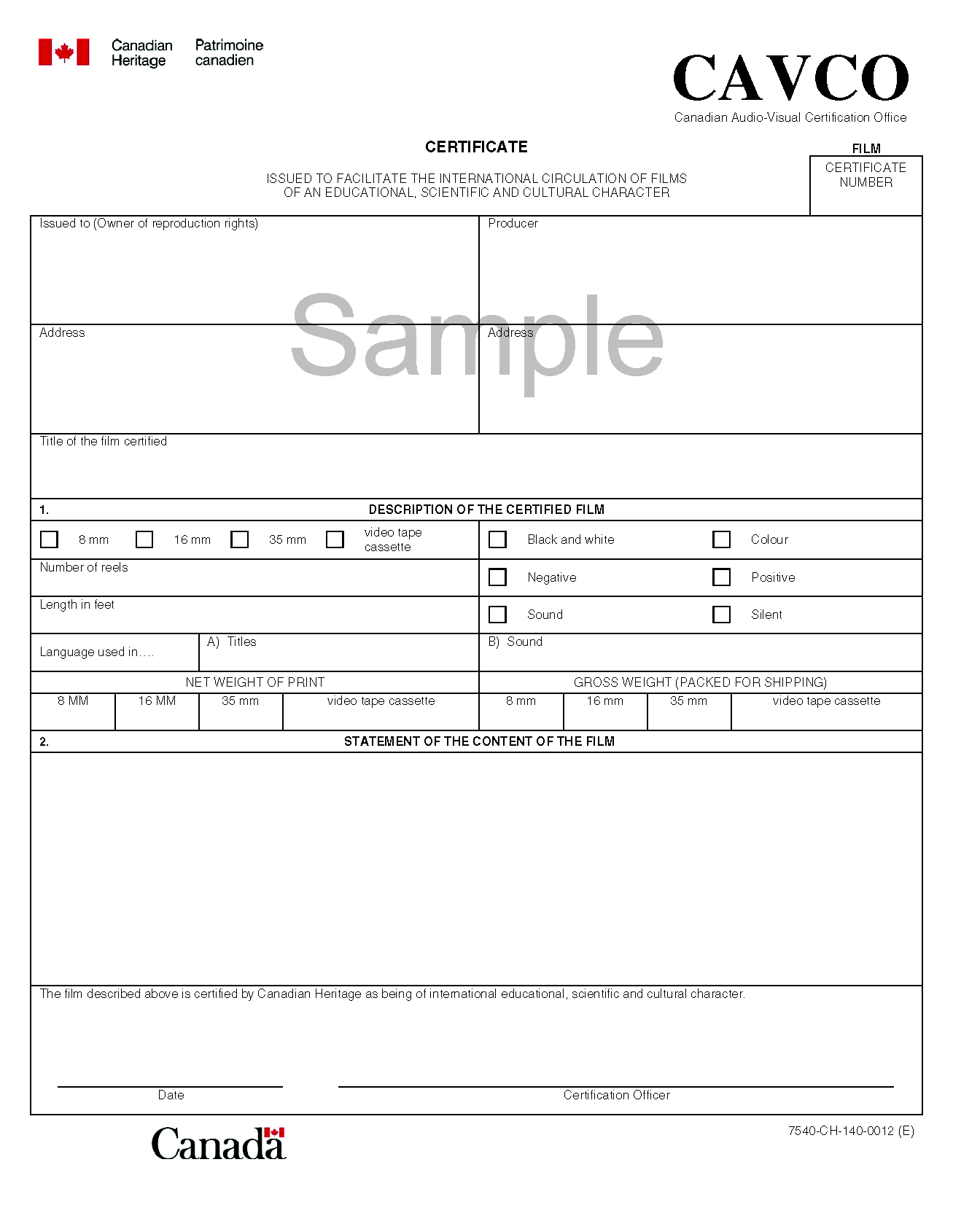

7. Furthermore, goods eligible for classification under the listed tariff items that were originally produced in Canada but are distributed from abroad may be classified under the applicable tariff provision when certified by the Department of Canadian Heritage. Refer to the Appendix for a sample certificate.

8. Only goods listed on the certificate may be classified under the listed tariff items. Goods contained in the same shipment but not listed on the certificate must be classified under the appropriate provision of the Customs Tariff.

9. If certification for the goods is obtained after the date of accounting, the person who paid duties on the imported goods may apply for a refund. An application for a refund of duties must be filed on Form B2, Canada Customs – Adjustment Request, and in accordance with the provisions of the Customs Act. A copy of the requisite certificate should be attached to Form B2.

10. For more information relating to the refund of duties paid on imported goods, refer to Memorandum D6-2-3, Refund of Duties. For information on the coding and processing of Form B2, refer to Memoranda D17-2-1, Coding of Adjustment Request Forms, and D17-2-2, Processing of Adjustment Request Forms.

Additional Information

11. For certainty regarding the tariff classification of a particular good, importers may request an advance ruling. Details on how to make such a request are found in Memorandum D11-11-3, Advance Rulings for Tariff Classification.

12. For more information, call contact the CBSA Border Information Service (BIS):

Calls within Canada & the United States (toll free): 1-800-461-9999

Calls outside Canada & the United States (long distance charges apply):

1-204-983-3550 or 1-506-636-5064

TTY: 1-866-335-3237

Contact Us online (webform)

Contact Us at the CBSA website

Appendix

This certificate is used for Canadian exports of films and may resemble certificates that other countries issue for their exports to Canada.

References

- Issuing office:

- Trade and Anti-dumping Programs Directorate

- Headquarters file:

- HS3705.90

- Legislative references:

- Customs Act

Customs Tariff - Other references:

- Beirut Agreement, 1948.

D6-2-3, D11-11-3. D17-2-1, D17-2-2,

Form B2 - Superseded memorandum D:

- D10-15-3 dated November 16, 2006

- Date modified: